'Article Pick' : COVID-19 tanked India’s carbon emissions, but (government’s fiscal) stimulus will drive them up again.

With the COVID-19 fiscal package dominating the news this week, we have picked up a ‘DownToEarth’ published piece written by Tarun Gopalakrishnan (Climate Change, Centre For Science and Environment).

The article focuses on the INR 90,000 crores liquidity infusion , announced by the Government of India (on 13th May 2020) into the power distribution companies (also known as DISCOMs) , as part of the stimulus package to help the Indian economy recover from the coronavirus crisis.

Gopalakrishnan expresses a certain disappointment at the “emission-neutral” nature of the Government’s stimulus. He explores, instead, how such an investment could have been prioritised for a more balanced recovery of India’s energy sector.

-

3 OnePointFive SideNotes to help you understand the argument:

1. India’s Power Generation

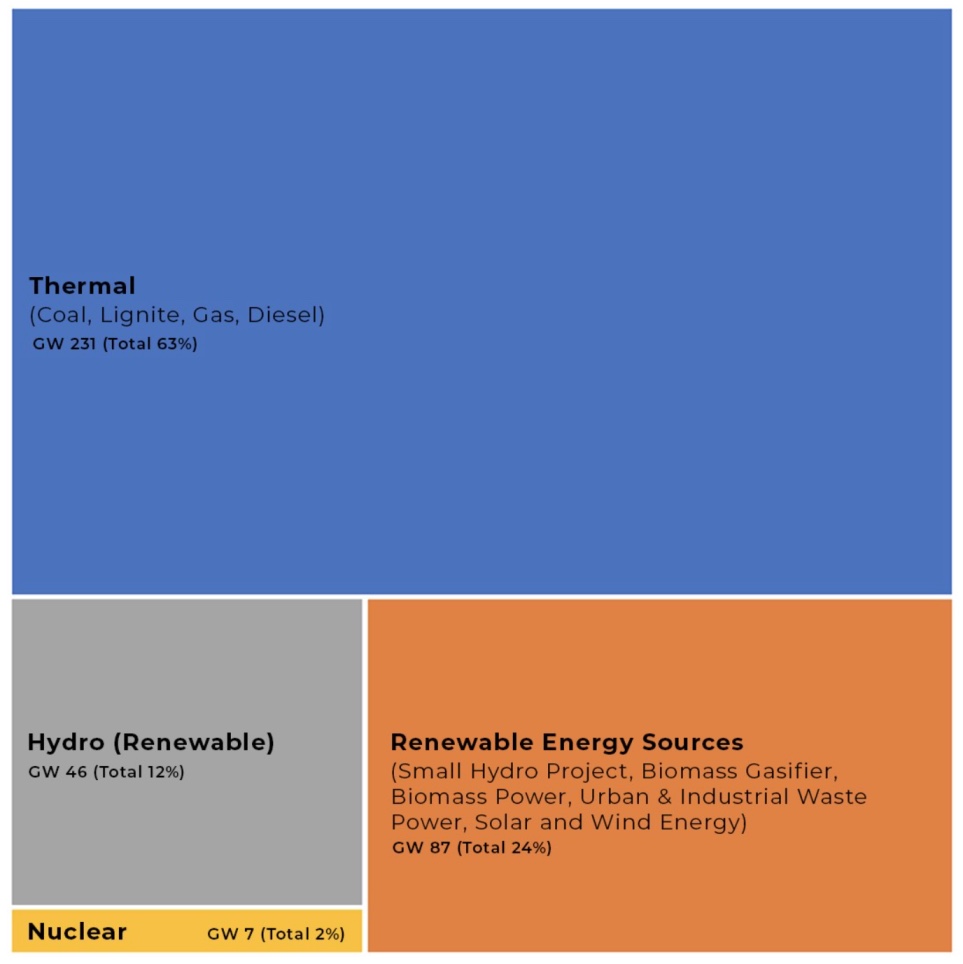

While renewable power generation gradually increases in India, the power sectors in India is still led thermal power plants accounting for 63% of installed capacity in the country. The electricity generated in thermal power plants is highly carbon intensive and probably, the biggest contributor of carbon emission leading to climate change.

New measures have been taken up by several Governments around the world, to close down thermal power plants, in favour of new renewables power generation. Progress made in UK and Germany, are good examples of this !

Total Installed Power Generation Capacity Breakdown in India

Notice : Thermal 63%

2. Global View on COVID Fiscal Stimulus

Leaders from around the world, have acknowledged that the (gigantic) COVID fiscal package being announced by Governments around the world for economic recover from the coronavirus crisis — offers an opportunity to deploy stimulus not only to overcome this crisis more resiliently, but put countries on track to contain the coming climate crisis.

It simply doesn’t make economic sense to ignore climate change in our recovery from the pandemic !

Many European countries are already embarking on a ‘green’ fiscal stimulus to rebuild their economies, while several other countries are beginning to consider similar approaches.

3. Here’s why DISCOMs in INDIA needed help in the first place:

The revenue of DISCOM’s largely rely on higher than the ‘true power tariff’ charged to industries (factories) and the commercial sector (shops, malls) of our country.

This revenue generated is expected not only to keep the DISCOMs financially viable, but also make up for the lower than ‘true power tariff’ offered to certain other segments such as agriculture & domestic category, by governments.

It is this prolonged ‘low power tariff’ that has burnt a hole in the DISCOMs balance sheets; and have left them perennially at loss. This has in-turn led to DISCOMs unable to pay power generation and transmission companies that supply electricity to DISCOMs for Distribution — effecting the whole energy sector.

To make things more challenging, the grim finances of the DISCOMs are unlikely to change due to the lack of political will to increase the end-use tariff.

In amidst such a reality, the COVID-19 lockdown shut the industries and the commercial sector — the two main income sources for DISCOMs, putting them on a financial tailspin.

It is in this backdrop that on May 13, the finance minister, as part of GOI stimulus package to help the Indian economy recover from the coronavirus crisis announced Rs 90,000 crore in loans to DISCOMs in India.

These funds are intended to solely help DISCOMs clear liabilities upwards in the value chain to power generation and transmission companies — who in turn are expected to clear their outstanding to suppliers such as coal miners and contract miners.

-

Gopalakrishnan , in the article, acknowledges that the stimulus package has been received with enthusiasms by the power sector , but argues that there is a massive missed opportunity by the government to consider emission reductions . He argues this one-time Rs 90,000-crore liquidity injection is emissions-neutral and offers no incentive to DISCOMs to prioritise the renewable energy suppliers, by them.

In a country of surplus installed electricity capacity, where DISCOMs can prioritise power suppliers for distribution to end-use, the power from old (and often inefficient) coal plants, which appear “cheaper” to DISCOMs has been preferred over new renewables counterparts.

Even though renewable energy has been granted priority access to the grid (‘must-run’ status), as Gopalakrishnan points out, DISCOMs have often violated this, with minimal warning or explanation to renewable power suppliers. Further at the COVID-19 crisis, many state-owned DISCOMs have turned to “force majeure” as a justification for undermining the renewable priority access.

All said, the renewables find themselves in a backfoot compared to fossil power suppliers, when it comes to the last leg of power distribution to end users via DISCOMs.

It is in this light that the renewables energy sector (accounting for 35.9% of India’s installed electricity generation capacity) needed government intervention all along and more so, amidst the pandemic.

The Government of India stimulus not only lacked any renewables-focused earmarks, Gopalakrishnan argues that a climate-responsible stimulus should have atleast attached conditions to this Rs 90,000 crore, particularly regarding payment of renewable power generators on time and minimal derogations from legally granted priority due to renewables.

Rs 90,000 crore had also offered opportunities to improve energy sector performance by expansion of smart metering and reduction in distribution losses. More ambitiously, this stimulus could have allocated funds towards closure of old (and often inefficient) thermal power plants, in line with emerging climate policy and making room for more renewables.

“The lack of imagination on the government’s front does not augur well for a balanced recovery (of the energy sector).”

-

Article Pick is a OnePointFive Blog Series , where we bring to our members interesting articles from around the world that indulge in latest conversations in the realm of climate change, buildings and the building industry.

Follow OnePointFive on Facebook, Instagram and LinkedIn.

OnePointFive

Posted on 22 May 2020