Article Pick : Will Low Oil Prices Help or Hurt the Fight Against Climate Change?

This week, we have picked up a very interesting article by Justin Worland, who covers energy and the environment for TIME.

In the article, he explores the potential impact of the free fall of ‘oil prices’ — that we saw this last week amidst the COVID-19 Pandemic — on the global energy transition from fossil fuels to renewables.

-

OnePointFive encourages its members to read the article to get a top view of how the oil prices can affect the gradual energy transition, as is necessary to avoid irreversible climate change.

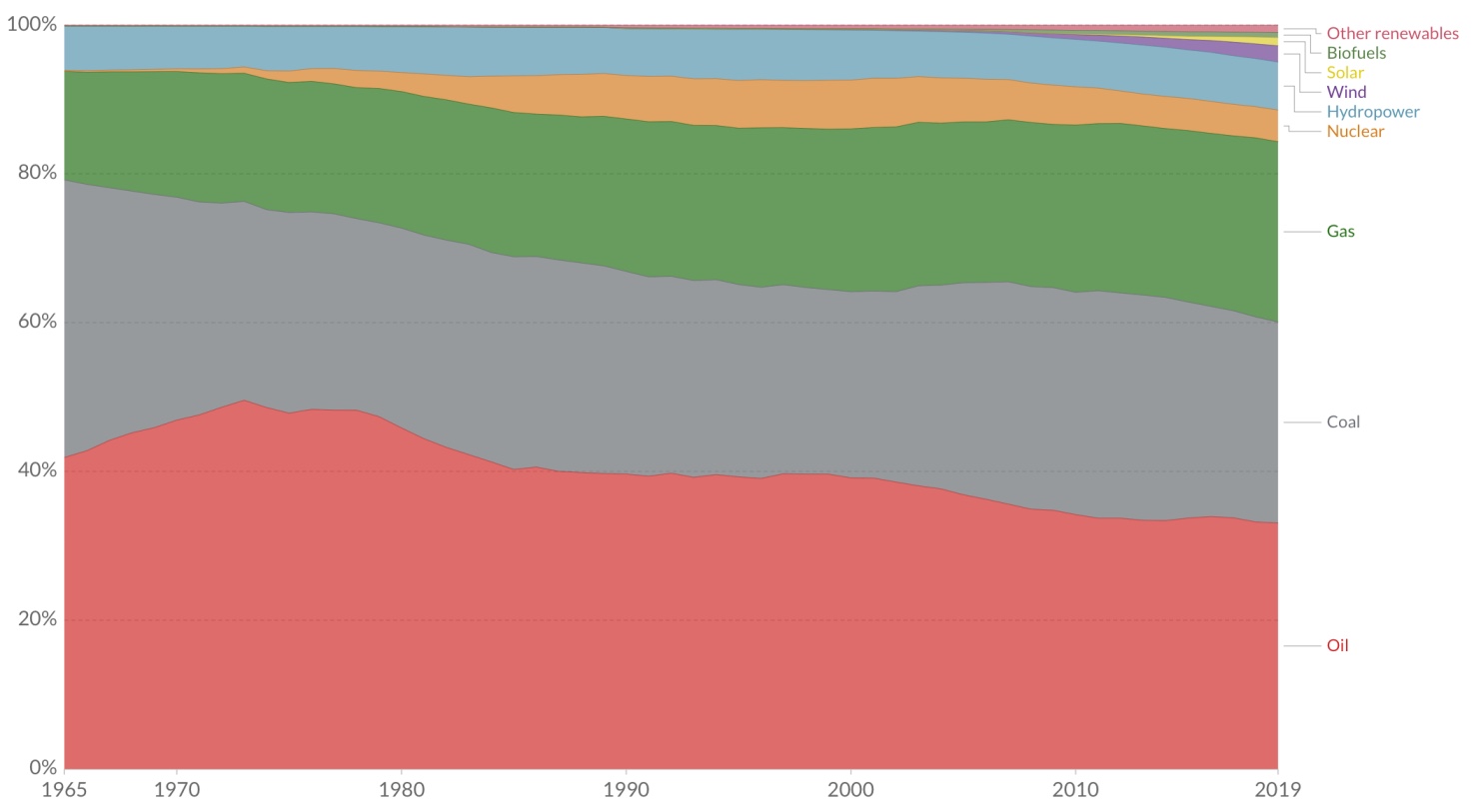

Fossil fuels , which is a key source of carbon dioxide, is a dominant source of global energy consumption. In fact, if you dig deeper into the trend, you will notice that oil has been the largest source of global energy consumption for a long time, with a total percentage share of 33.19, in 2018. However, the recent collapse of oil price is not an all win for the climate movement as it may seem at the outset. Possible outcomes need cautionary exploration !

Energy Consumption by Source (% breakdown)

Notice : Oil (red)

-

In the article, Worland makes an argument that the historically low oil prices of today, can weaken the investment case for oil companies. He observes that low oil prices for the prolonged period, will challenge the profitability of oil companies, as it may become increasing difficult to “turn a profit on a new oil well”.

Subjected to this low profitability scenario, he points out that going forward oil companies may find it difficult to access the capital they need to grow and survive, as loans may grow more expensive for them. As a result, some smaller oil firms “may go bankrupt” or be “forced to wind down existing assets”. Still others, particularly big oil majors, “may feel pressured to invest in clean energy to stay relevant in the future market on the other side of the energy transition.”

While this may sound like a much-awaited positive development in favour of the climate movement, there is a flipside, Worland warms . He cautions that the same low oil prices can become a hurdle in a transition away from fossil fuels. He states low oil prices will fail to provide sufficient incentive for businesses and consumers to transition away from fossil fuel. “Instead it may only entice utilities, policymakers and society at large to continue to rely on the fossil fuel” as a primary source of energy rather than looking to renewable alternatives.

Worland concludes that in the coming months, as political leaders across the globe plan an economic recovery, it is the decisions they make for the recovery of the energy sector, that will ultimately influence whether the current low ‘oil prices’ encourages or deters the global energy transition.

“Political leaders will have the option of choosing to double down on fossil fuel infrastructure, inspired in part by low oil prices, or invest in clean energy, recognizing the long-term economic trends and the urgent threat of climate change.”

-

Article Pick is a OnePointFive Blog Series , where we bring to our members interesting articles from around the world that indulge in latest conversations in the realm of climate change, buildings and the building industry.

Follow OnePointFive on Facebook, Instagram and LinkedIn.

OnePointFive

Posted on 28 April 2020